The automotive sector is constantly in the news. In September 2024, Volkswagen announced the potential closure of several German factories, which had never occurred before. This prompted the largest strike in the company’s history, with around 100,000 workers participating. Meanwhile, in early 2025, the biggest bid to develop a European competitor in the electric battery market filed for bankruptcy.

In the Basque Country in particular, we are paying close attention to all the events surrounding this issue because it directly affects our business community. In May, the labour dispute at Bridgestone in Basauri ended with 232 redundancies. Mercedes-Benz Spain has suffered a 70% reduction in profits, coinciding with a reduction in production at its Vitoria-Gasteiz factory.

But what proportion of our activity does the automotive sector really account for? In a broad sense, the automotive sector is not limited to car or parts manufacturers. It includes suppliers of all those goods and services that only exist to the extent that private vehicles are the main means of transport. The construction of motorways, oil extraction and refining, a large part of insurance and even the construction of certain suburban areas or commuter towns are activities that are closely linked to the centrality of the car in socio-spatial reality. Quantifying the weight of this ecosystem is certainly a complex task.

According to the source, estimates of the weight of the automotive industry in the Basque economy vary considerably. The Basque Government estimates that the sector accounts for 25% of the Basque Autonomous Community’s GDP, though this figure is disputed and some sources suggest it is closer to 35% of industrial GDP (8.75% of GDP). A conservative estimate based solely on vehicle and component exports (excluding imports), household expenditure on motor vehicles, and car manufacturer investment would place the sector’s importance at around 10.4% of GDP in 2023.

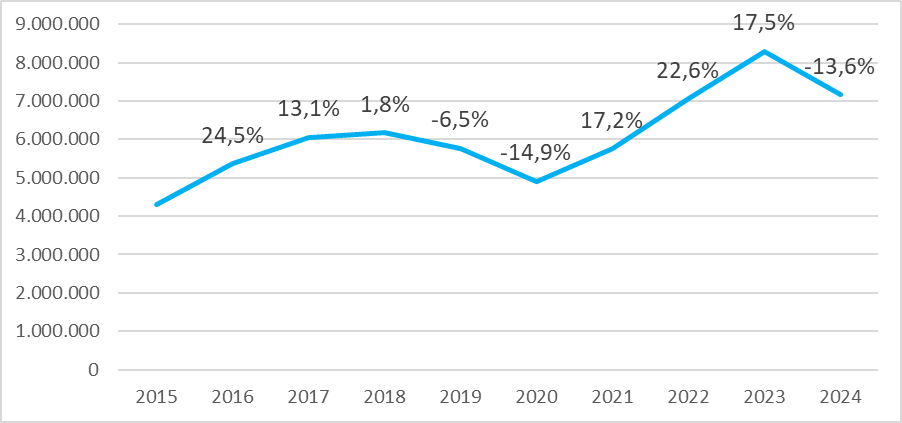

Their prominence in total exports is also noteworthy: around a quarter of all exported goods are cars and components, a figure that rises to over half in the case of Araba. The Basque Country also has a positive balance in this regard, with exports being almost six times greater than imports.

Certainly, more research is needed on the true importance of the automotive sector in terms of GDP, and on the scope of the sector in the Basque Country, adopting a more holistic approach. It is important to understand the automotive industry not only as another economic sector, but also as an interrelated system, in line with important academic references in the field, such as Giulio Mattioli and John Urry. In any case, these figures alone are sufficient to corroborate the importance (and dependence) of the automotive sector in the Basque Country, as is also the case in Navarre.

The automotive ecosystem is therefore a central pillar of the Basque economy. The geographical proximity of all the links in the value chain in the Basque Country, as well as the comprehensiveness of this chain (which includes everything from raw materials and capital goods manufacturers to toolmakers and machinists, as well as universities, research centres, consultancies and engineering firms), are assets that have facilitated growth in the sector by saving transport costs and promoting economies of agglomeration.

However, this high degree of geographical concentration, which has yielded good results, would also amplify the negative effects of a systemic crisis in the sector. A shortage of supply in one branch could cause a domino effect throughout the automotive industry. The sector’s high capital intensity and fixed capital costs mean that investing in it under conditions of uncertainty is even riskier in a crisis context (and precedents such as Nortvolt do not reassure investors in this regard).

The coming years will see profound changes in the productive geography of the automotive industry, with a growing number of Asian companies setting up in Europe, while local competitors will try to survive in the electric vehicle and components market, which is set to grow in importance provided there are no populist political changes à la Trump in the EU.

Public policy professionals, private sector experts, public administrations, etc. are right to monitor the health of the automotive sector closely, as it holds many of the secrets to economic stability in an environment such as the Basque Country. The only thing that is clear is that the future of the European continent in general, and of the Basque Country in particular, is closely linked to the future of the automotive sector. Understanding its reality and anticipating changes may be the only solution.

Illustration: Jason Mitrione